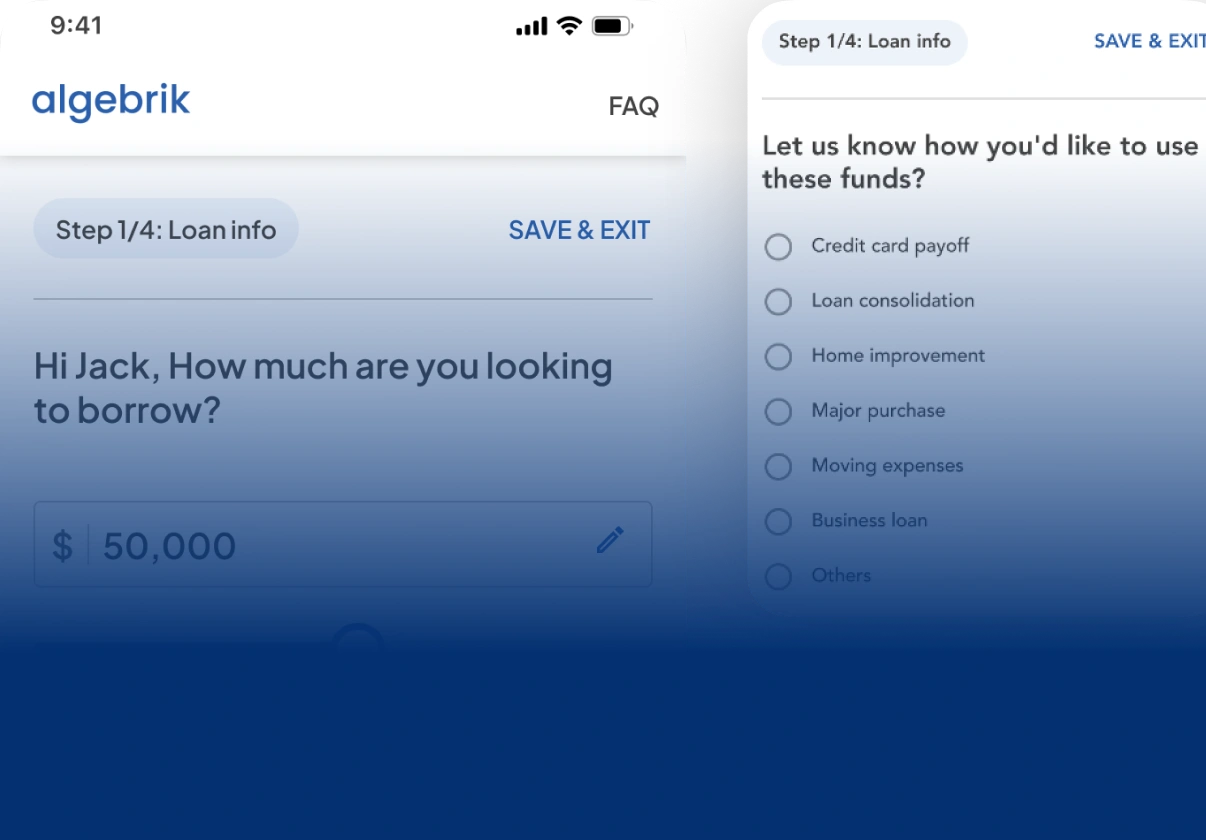

The Loan Origination Suite that actually runs lending.

The World's first cloud-native, AI-powered Loan Origination Suite turns disconnected lending steps into one continuous, automated origination process.

Digital Account Opening

Document Processing

Point of Sale

Borrower Communication

AI powered Decisioning

Origination

Member Verification

Application Management

Portfolio Analytics

AI Lender Enablement

Digital Account Opening

Document Processing

Point of Sale

Borrower Communication

AI powered Decisioning

Origination

Member Verification

Application Management

Portfolio Analytics

AI Lender Enablement

Digital Account Opening

Document Processing

Point of Sale

Borrower Communication

AI powered Decisioning

Origination

Member Verification

Application Management

Portfolio Analytics

AI Lender Enablement

Digital Account Opening

Document Processing

Point of Sale

Borrower Communication

AI powered Decisioning

Origination

Member Verification

Application Management

Portfolio Analytics

AI Lender Enablement

Digital Account Opening

Document Processing

Point of Sale

Borrower Communication

AI powered Decisioning

Origination

Member Verification

Application Management

Portfolio Analytics

AI Lender Enablement

Hina Khalid

Chief Financial Officer

LeAnne Hixson

Chief Lending Officer

Michael Barnhardt Jr

Chief Lending Officer

Guided by theBest in the FieldGuided by the best in the Field

Our Advisory Board brings together industry leaders and visionaries, guiding Algebrik AI with strategic insights, deep expertise, and a shared commitment to transforming lending into a seamless and inclusive experience.